One of the questions I am often asked is to clarify Canadian spirits taxation laws, how they function regionally and nationally. The spirits taxation scheme in Canada is refreshingly noncomplex, however what can become contentious is when the affect of these laws trickle down to the distillery and agricultural level; the direct impact these laws have on spirits producers and distributers, and those who grow the grains used to create our favourite drams.

The first thing to understand is that spirits’ taxes are administered and enforced provincially falling under the Canadian Federal Fair Trade Agreement. This agreement supports the Canadian Agreement on Internal Trade (CAIT), an agreement that is protected under the Canadian Constitution. The section of our Constitution securing the freedom of movement of persons and goods within Canada is Section 6 of the Canadian Charter of Rights and Freedoms (CCRF) more affectionately known as The Charter. In the year of our Lord 1982 The Charter ascended into Canadian law during HM Queen Elizabeth II twelfth visit to Canada. In my lifetime, I have only known a Canada that is loving and tolerate towards all persons of every race, sexual orientation, age and gender (CCRF Section 7), making Canada one of the safest and most welcoming nation-state’s in the world. I am exceedingly proud to be a Royal Canadian Navy Veteran.

Getting back to whisky, the CAIT is an agreement passed in 2017 by every Canadian Province and Territory, which serves to improve the quality of life for all Canadians protecting our right to freedom of movement of persons and goods anywhere within Canada subject to provincial legislative requirements at law. Basically, this means that us Canuckers have the legal right to go on a road trip to visit our families who might live 2000km several provinces away nearly half way across the country. Moreover, owing to Section 6 of The Charter we possess the legal right to transport commercial goods from any part of Canada to any other part of the country. For example, a sea container coming off a merchant ship in the Port of Halifax Nova Scotia on Canada’s east coast can be placed onto a train and transported 1200 kilometers to a truck depot (Intermodal Center example) in Montreal Quebec. This same sea container is then moved onto the back of a semitruck for highway transport a few hundred kilometers east to Sherbrooke, Quebec in La Belle Province. If you live in Canada or if you have the opportunity to visit our beautiful country and can take a moment to enjoy train spotting or watch the large merchant ships coming into port and travelling down river then you understand that commercial transportation of goods within Canada is the result of our embracing Constitution, which provides safety and security for every Canadian.

“It is the objective of the Parties to reduce and eliminate, to the extent possible, barriers to the free movement of persons, goods, services and investments within Canada and to establish an open, efficient and stable domestic market. All Parties recognize and agree that enhancing trade and mobility within Canada would contribute to the attainment of this goal.”

Reference: The [Canadian] Agreement on International Trade PART I – GENERAL

Chapter One, Operating Principles, Article 100: Objective

Every province’s taxation scheme is slightly different but the concept across the country is the same: get the goods where they’re supposed to be on time, in good repair, and at a reasonable cost to distributers and consumers. Of course, a reasonable cost is subjective and requires a fairly delicate balance between taxation needs of the province and the quality of life for distributors and consumers, a tricky balance to achieve one which inevitably makes no one happy. Such is life for the tax collector. I can only imagine how many bottles of excellent whisky are consumed per year by people in these roles coping with trying to keep the rest of us the least unhappy as possible under prevailing circumstances. Perhaps, there’s some method to the madness after all? I can tell you that as a whisky blogger having a good excuse to partake in a fine bottle of Scotch, rye or bourbon certainly comes with its many perks.

Taxation Rates of Spirits by Province and Territory

- British Columbia: 10% on retail price of bottle

- Alberta: Greater than 60% alcohol by volume is $18.33/Litre, and greater than 22% & less than or equal to 60% alcohol by volume is $13.76/Litre (if you’re curious about taxes on spirits below 40%abv click here)

- Saskatchewan: This province is the same as B.C.

- Manitoba: approximately 80% on retail price of bottle

- Ontario: 61.5% on retail price of bottle

- Quebec: 72 cents per Litre

- New Brunswick: 5% on retail price of bottle

- Prince Edward Island: 25% on retail price of bottle

- Nova Scotia: 15% on retail price of bottle

- Newfoundland and Labrador: 15% on retail price of bottle

- Yukon: 12% on retail price of bottle

- Northwest Territories: $28.00 per Litre

- Nunavut: “Nunavut is one of the only jurisdictions in Canada that does not currently levy a tax on alcohol either directly (as Bill 56 proposes) or through a wider sales tax (like an HST or PST). The proposed tax would be levied on consumers as a percentage of a product’s retail price.” ~ Quote from Government of Nunavut website on Liquor Tax

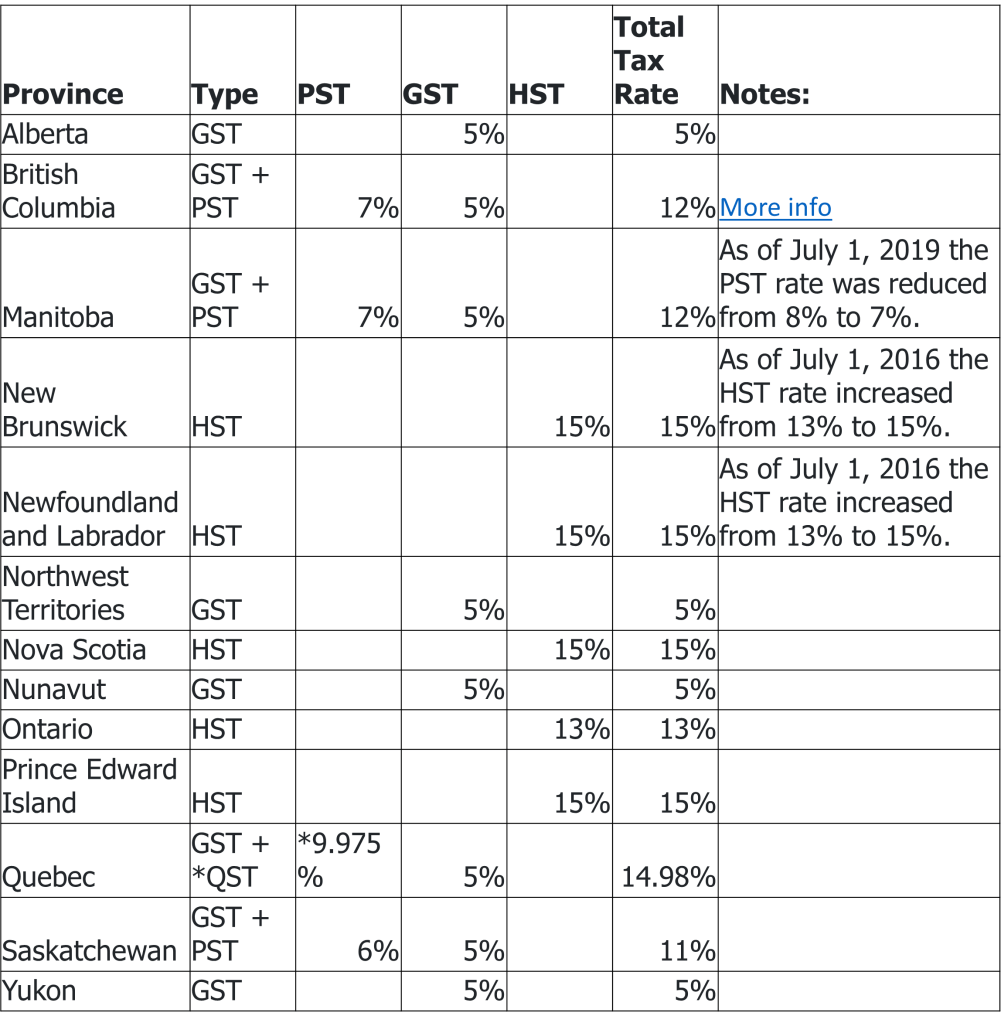

We have three types of taxes in Canada: Provincial Sales Tax that varies by province and averages around 7%; Government sales tax at a rate of 5% in all provinces and territories, which is applied to alcoholic beverages; and, Harmonized Sales Tax, which is usually 15% except in Ontario where it is 13%. HST is in lieu of GST/PST, which are combined in other provinces (reference Table 1 below). The HST is quite interesting as it pertains to the sale of alcohol because there are two ways to apply HST when it comes to beverages. The first method of applying HST is “taxable,” which is as simple as it sounds, adding HST to goods when at the cashier. For example, in Ontario a commodity that retails for $10.00 CAD ends up costing you $11.30 at the register due to a 13% HST tax. However, alcohol is different. Although, you are charged HST on alcoholic beverages the HST tax rate is 0%. You read that right, zero percent HST. In Ontario a bottle of whisky sitting on the shelf listed for $35.00 CAD will cost you $35 at the register. This rate of 0% HST on alcohol is described by the Canada Revenue Agency. The purpose for having a “zero rated” tax is to provide a tax benefit to some consumers, a tax credit:

“A zero-rated supply has a 0% GST/HST rate throughout all of Canada. For example, basic groceries are taxable at the rate of zero (0% GST/HST) in every province and territory. The rate for other taxable supplies depends on the province or territory…This means that you do not charge GST/HST on these supplies, but you may be eligible to claim input tax credits (ITCs) for the GST/HST paid or payable on property and services acquired to provide these supplies.”

Reference: Canada Revenue Agency – Which [Tax] Rate to Charge , and Zero Rated Supplies

Current as of 13 September 2022

I live in Ontario currently having moved here from British Columbia in the late 2000s. What’s been really interesting for me since living in Ontario is the zero-rated HST on alcohol. What that means is back home when I would pick-up a $13.00 bottle of wine from the shelf when I got to the cashier I had to pay $14.56 taking into account the 5% Government Sales Tax and 10% Provincial Sales Tax. Whereas, in Ontario a bottle of local rye retailing for $33.50 on the shelf costs me $33.50 at the cashier. I’m not sure how other Ontarians feel about this but having moved here from out of province I rather like knowing exactly what I’ll be forking out at the cash register. For me, it’s a convenience and a small yet meaningful comfort in my life.

What Local Distilleries and Farmers Think About All This Tax

One of the primary frustrations I’ve heard some Canadian spirits producers share with me in confidence are the difficulties they experience due to high spirits taxation rates whereby the only way the distillery can turn a meaningful profit is producing and selling large volumes of spirits to compensate for the amount of tax reaped by the province. For whisky consumers this isn’t terrible because that means we have plenty of spirits available for purchase. With these large numbers flying around the natural question to ask is how come we are being taxed so much on alcohol in Canada when it makes life more difficult for distilleries? The primary reason for higher taxes on alcohol in Canada is to reduce occurrences of public drunkeness, contribute to lowering cancer rates in the community, and to improve the populations’ overall health and well-being. To further enhance these initiatives some of the taxes from the sale of every bottle of alcohol are redistributed at the provincial level into programs and infrastructure that improve the well-being of society. One such example in Alberta involves taxes from liquor markup going into the province’s General Revenue Fund, which funds several projects across the province including child intervention services, environment and parks, the energy sector and health care (reference Alberta Government – General Revenue Fund). Of course, all of these are excellent reasons to utilize higher taxation rates as a means to discourage overconsumption of alcohol within Canada’s public. However, in a world where maintaining a healthy and enjoyable standard of living was becoming increasingly more difficult high tax rates proved frustrating for our multi award winning spirits producers who strive forward to keep Canada’s spirits sector thriving, something they are superior at achieving. I haven’t spoken directly with farmers, but from what I have read the spirits industry is an important client for Canadian agriculture. The Canadian spirits industry is said to support close to 9000 full-time Canadian farming jobs and puts $5.8 billion annually into Canada’s GDP (Reference: Ottawa Life Magazine). Perhaps, due consideration ought to be given at the provincial level to determine reasonable yet meaningful ways for alleviating present taxation hardships on distillery owners in favour of quality of life for these Canadians? I think so.

Fortunately, higher tax rates on spirits hasn’t negatively impacted the quality of new make coming off Canadian stills. Canadian whisky has a historical reputation for producing smooth comforting whiskies that were ideal for farmers and loggers working long hours on the farm or in one of our many dense forests. Canadian whiskies also have a historical reputation for raising spirits, pun not intended, in the office where many a business deal was conducted over drams poured from a lead crystal decanter enjoyed in a velvety earthen leather chair. In modern times, Canada retains its classics such as J.P. Wiser’s, Canadian Club and Crown Royal, the crowd pleasers warming the cockles of our Canadian hearts from my French-Irish Canadian grand-père’s low ball glass on ice to the boardrooms with 50 years aged CC neat. Award winning Canadian whiskies are continuing to appear on the market including bottles such as the Pike Creek 22, which won World’s Best Blended Limited Release in this year’s World Whiskies Awards.

It isn’t exactly the wild west here in Canada when it comes to spirits taxation laws despite what you may have heard. Some people tend to exaggerate the context of high taxation likening it to some government conspiracy aimed at the consumer and distillery owner. Not so. Rather, Canadian taxation laws cut to the heart of our caring and compassionate Canadian culture, one that recognizes both the need to protect public health whilst respecting our inherent right to self determination. If you’re of age go ahead and drink if you want to and do so responsibly out of care and conscientiousness to yourself and others around you in the community. As with everything in government there is always room for improvement. I am overall fairly satisfied with the Canadian spirits taxation laws and the manner in which they uphold our Constitution demanding the fairest and most equitable treatment for all. Researching this topic and writing about it has reminded me yet again why I am utterly grateful to be Canadian. On that note, I’m going to get up from my chair, walk to my liquor cabinet in the living room, take out a bottle of Canadian rye and pour a dram to celebrate what I think is the greatest Constitution on earth along with all of the rights and privileges that come with living in the land of the True North Strong and Free. To Her Majesty Queen Elizabeth II for a safe Canada under The Charter. Slàinte

God bless The King and long may He reign.

About the author: HRH Chantaille Buczynski, CD, BSc, Esq, RCN is a proud mother of two perfect young children, a retired Naval Officer, a bandsman on drum and flute, a dancer of Irish and Highland dance, and an exceedingly proud French-Irish and Scottish Canadian with a black background. HRH Chantaille’s love is of Algonquin and English origins. Together, they are an all Canadian family.